Automating Our Travel Budget

by Jason -- November 26, 2009

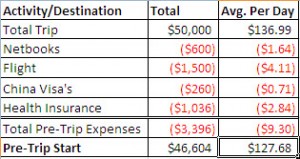

In a previous post I discussed how Sharon and I saved $50,000 and are now traveling for the next year (minimum). The key to our success with this goal was automating our savings plan. In this post, I explain how we plan on keeping our spending and budget in check the exact same way.

The “Twitter” answer is that we determined how much money we wanted to spend on a bi-weekly basis and then had that amount transferred automatically into our checking account every 2 weeks. Here’s how we did it:

Determining The Bi-weekly Budget

We started by looking at our target spend per day. After our pre-trip expenses, we were left with a budget of $127.68 per day.

On a weekly basis, this gives us $893.78 and on a bi-weekly basis this gives $1787.55.

If we planned on spending every one of the $50,000 dollars, we could setup our budget around spending $1787.55 every 2 weeks, but we’ve decided to hold some of that back for other potential expenses (i.e. traveling beyond a year). After discussion, we decided on 80% of the $1787-it’s an arbitrary amount, but it felt right.

Automating Our Budget

Now that the amount to be deposited on a bi-weekly basis has been determined, the last step was to automate our budget to this amount. The reason we’re able to do this so easily is that we pay cash for essentially everything. Credit cards are typically not accepted and we get a great exchange rate by using cash. By transferring money from our savings account to our checking account, it’s practically impossible to go over our budget. Sure, we could overdraw our checking account, but it’s easy to prevent that when you get a receipt with every withdrawal.

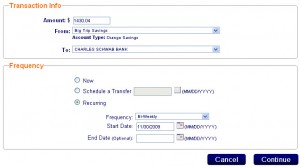

Our Savings Account is ING and they make it very easy to automatically deposit money into our linked checking account on a bi-weekly basis. 5 easy steps:

- Determine the ING account to draw from (You can setup multiple sub-accounts)

- Choose the checking account you’d like to deposit the money into

- Input the amount you’d like to withdraw

- Choose the frequency with which you’d like the money to be deposited

- Select the date you’d like the deposits to begin

It takes a couple minutes, but now our budget is automatically managed for us.

We’ll be monitoring our daily spending to ensure we’re staying within our budget as well. But because life just seems to get in the way of these monotonous, boring tasks-as a safeguard we’ve setup our ING account and checking accounts to manage our budget for us. If the money’s in our checking account, we know we can spend it guilt-free.

How can you apply this to your own Finances/Budget?

In an extreme example, you could also manage your entire budget in this fashion and spend cash only.

You could also manage certain portions of your budget with this method, such as eating out, groceries, entertainment, etc. A good method I’ve read about is called the “envelope method“. The method I’ve described above essentially creates a virtual envelope.

Download our full Trip Finances spreadsheet

Be awesome and help us share:

[…] weeks to realize that this was far beyond what we actually needed. We quickly recalculated and then automated our financial setup so as to alleviate any concerns about overspending our […]